Explain Different Techniques of Capital Budgeting

The major methods of capital budgeting include discounted cash flow payback and throughput analyses. Top Capital Budgeting Methods 1 Payback Period Method.

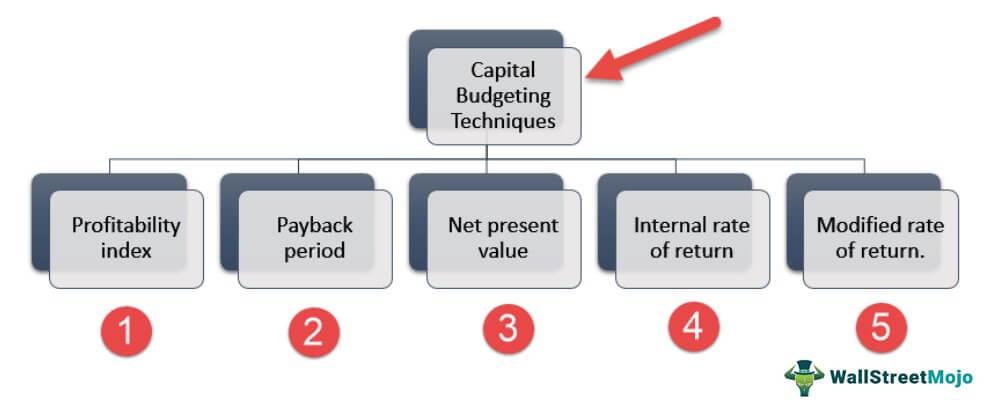

Capital Budgeting Techniques List Of Top 5 With Examples

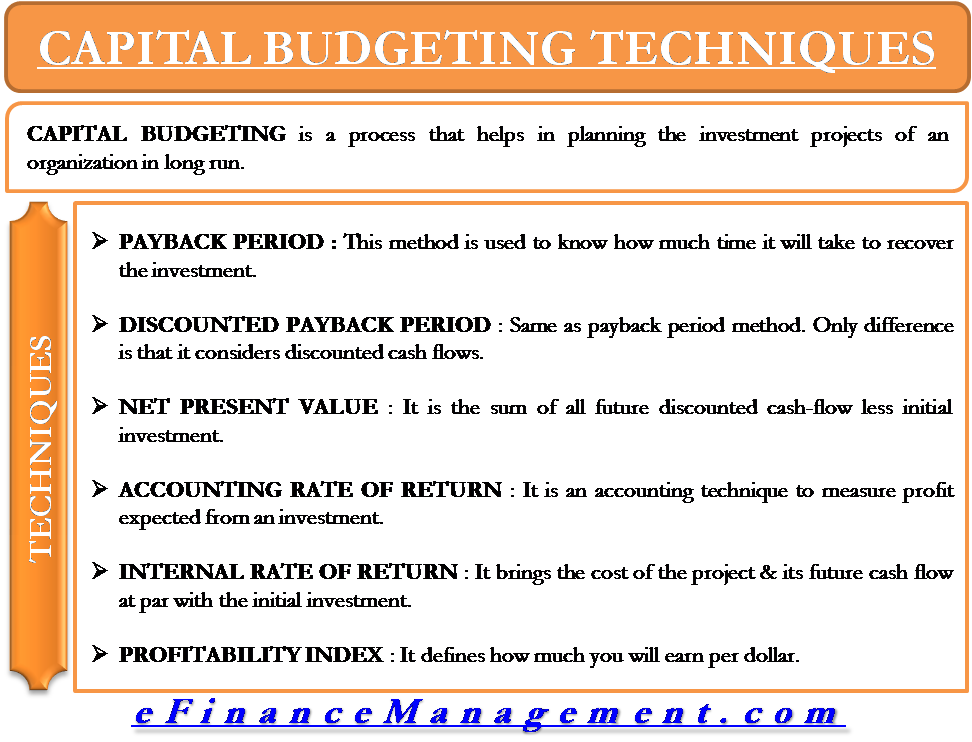

There are a number of capital budgeting techniques available which include the following alternatives.

. Different capital budgeting techniques are. The time taken for an investment to be fully recovered. Some of the major techniques used to face risk factor in capital budgeting decisions are as follows.

Average rate of return ARR. The Capital Budgeting Features includes. Net Present Value NPV Profitability Index PI Internal Rate of Return.

Capital budgeting decisions are for the long term and are majorly irreversible in nature. These techniques are mostly based on estimations. It refers to the time taken by a proposed project to generate enough income to cover the.

Needs wants and savings. Disadvantages of Capital Budgeting. Payback period The payback period method is the simplest way to budget for a new project.

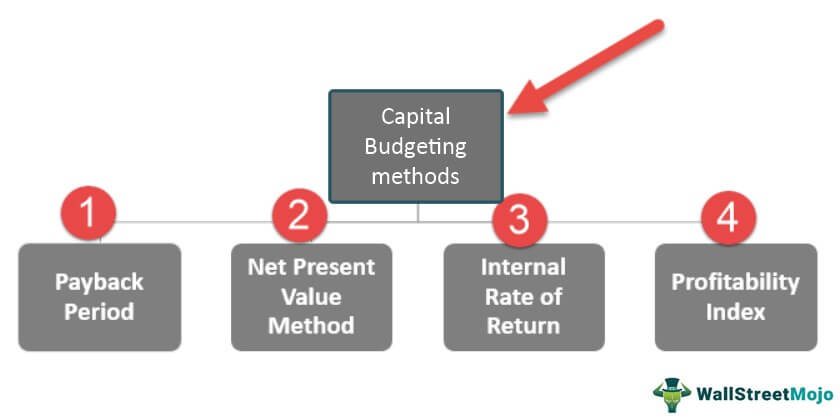

Net Present Value Method is the best capital budgeting method. Capital budgeting refers to the process of allocating cash expenditures to investment which have a life longer than the operating period normally a year. Payback period and Accounting rate of return.

2 Net Present Value Method. The payback period PB internal rate of return IRR and net present value NPV methods are the most common approaches to project selection. It measures the amount of.

There are different methods adopted for capital budgeting. It refers to the period in which the proposed project generates enough cash so that the. Everything you need to know about the techniques of capital budgeting.

Throughput analysis discounted cash flows analysis and payback analysis. Total investment divided by. Some of the techniques can be grouped in the two categories as mentioned below.

It measures the time taken for the investment to be ful. 50 percent of your take-home pay should go. The traditional methods or non discount methods include.

PBP is a fundamental capital budgeting technique which denotes the period that is required to break-even the project cash inflows and outflows. The 503020 budget is a simplified plan in which you break down your expenses into three categories. Although an ideal capital.

2 Net Present Value Method NPV. NPV gives importance to the time value of money. Following are the important techniques of capital budgeting.

TechniquesMethods of Capital Budgeting 1 Payback Period Method. It determines how much cash will flow in as a result of the. Investment proposal for which the Capital Budgeting technique is to be applied should be of a long-term nature.

It is assumed that the proposed. In other words capital budgeting or. To make this decision management typically uses these three main analyzes in the budgeting process.

Discounted Cash Flows Under the discounted cash flows method. To make it easier to figure out which projects are worth prioritizing many organizations use a combination of these five capital budgeting methods.

Capital Budgeting Methods Overiew Of Top 4 Method Of Capital Budgeting

What Are Capital Budgeting Techniques Definition And Meaning Business Jargons

Capital Budgeting Techniques With An Example Meaning Example

Comments

Post a Comment